Cash flow is the lifeblood of any business, and forecasting it accurately is essential for long-term success. For small and medium-sized enterprises (SMEs) in Botswana, understanding how to forecast cash flow can help avoid liquidity issues, plan for growth, and make informed financial decisions. This article will guide you through the process of forecasting cash flow, with specific insights tailored for Botswana businesses, helping you maintain healthy cash flow and stay on top of your financial obligations.

What is Cash Flow Forecasting?

Cash flow forecasting is the process of estimating the flow of cash into and out of your business over a specific period. It helps you predict future cash surpluses and shortfalls, giving you the information you need to manage your day-to-day operations effectively. A reliable cash flow forecast will enable you to plan for expenses, avoid running out of cash, and ensure that you can meet your financial commitments.

Why Cash Flow Forecasting is Crucial for Botswana Businesses

In Botswana, many SMEs face challenges such as inconsistent cash flow, seasonal sales fluctuations, and delays in receiving payments. By forecasting cash flow, business owners can:

- Identify potential cash shortages: By predicting when cash might be tight, businesses can secure additional funding or negotiate better payment terms with suppliers.

- Plan for future growth: Understanding cash flow trends enables you to plan for expansion, hire new staff, or invest in equipment.

- Manage expenses: A forecast helps businesses control their spending by ensuring they don’t overspend in lean periods.

- Avoid financial stress: Forecasting gives you peace of mind by providing a clearer picture of your financial health.

Steps to Forecast Cash Flow for Your Botswana Business

1. Gather Financial Data

The first step in creating an accurate cash flow forecast is to gather all relevant financial information. This includes historical data on your income, expenses, and any upcoming financial obligations.

Why it Matters:

Having detailed financial records will give you a solid foundation to predict future cash flow accurately. In Botswana, businesses often deal with irregular cash inflows, so understanding past patterns can provide valuable insights.

Key Data to Collect:

- Sales and Revenue: Historical sales data will help you project future income based on past performance.

- Payment Terms: Knowing your customers’ payment terms and the average time it takes to receive payments can affect your cash inflow predictions.

- Expenses: Track both fixed and variable costs such as rent, salaries, utilities, and raw materials.

- Loan and Credit Repayments: Don’t forget to include any loan repayments or interest charges you need to account for.

2. Choose a Forecasting Period

Decide on the time period for your cash flow forecast. For most SMEs in Botswana, forecasts are typically done monthly, quarterly, or annually. However, it’s common for businesses to create a 12-month cash flow forecast to get a clearer picture of their financial future.

Why it Matters:

The forecasting period will depend on the nature of your business. For example, businesses with seasonal fluctuations in income may benefit from shorter, more frequent forecasts, while businesses with steady cash flow may opt for longer-term forecasts.

3. Estimate Cash Inflows

Estimating your cash inflows is one of the most critical aspects of cash flow forecasting. You’ll need to predict how much money will come into your business and when.

How to Estimate Cash Inflows:

- Sales Forecasting: Base your sales projections on past sales data and any upcoming contracts or orders.

- Payment Schedules: Consider the payment terms with your customers (30 days, 60 days, etc.) to estimate when you’ll actually receive the payments.

- Additional Revenue Sources: Include any other income your business generates, such as interest, grants, or loans.

In Botswana, it’s important to factor in local payment patterns. Many businesses experience delays in payments from clients, so building in buffer periods for expected payments can help avoid short-term cash shortages.

4. Estimate Cash Outflows

Next, you’ll need to predict your business’s cash outflows—how much you will spend and when. This includes all your operating costs such as:

- Fixed Costs: These are predictable costs like rent, salaries, insurance, and utilities.

- Variable Costs: These include fluctuating expenses such as raw materials, inventory, and production costs.

- Debt Payments: Include any loans, credit facilities, or supplier payments due during the forecast period.

Why it Matters:

Accurate estimates of your cash outflows help ensure you don’t overspend or encounter unexpected financial pressure. Ensure you account for any one-off expenses or special projects that may come up during the forecasting period.

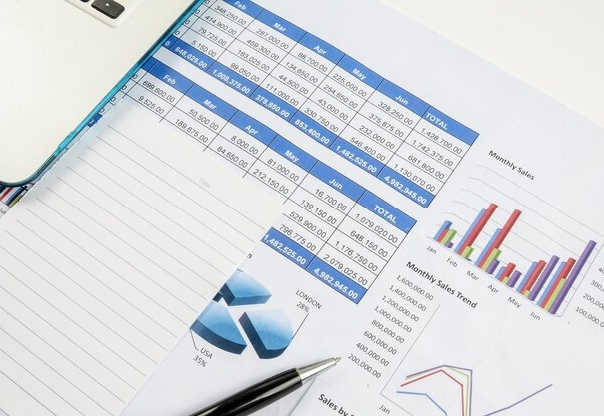

5. Create a Cash Flow Statement

Once you’ve gathered your inflow and outflow data, you can create a simple cash flow statement. This involves subtracting your total cash outflows from your total cash inflows to determine your net cash position for each period.

Cash Flow Statement Format:

- Opening Cash Balance: The amount of cash you have at the beginning of the period.

- Cash Inflows: The total amount of cash expected to come into the business during the period.

- Cash Outflows: The total amount of cash you expect to spend during the period.

- Net Cash Flow: The difference between cash inflows and outflows.

- Closing Cash Balance: The projected cash balance at the end of the period.

6. Review and Adjust the Forecast Regularly

Cash flow forecasting is not a one-time activity; it should be an ongoing process. Regularly review your forecast to ensure it reflects any changes in your business’s operations, customer payment habits, or unexpected costs.

Why it Matters:

By reviewing your forecast periodically, you can adjust for unforeseen circumstances such as delayed payments, changes in sales volume, or sudden expenses. Regular adjustments will help you stay on top of your business’s financial health.

7. Use Cash Flow Forecasting Tools

Many software platforms can simplify the process of forecasting cash flow, saving you time and increasing the accuracy of your projections. In Botswana, businesses can use both local and international tools to help automate their forecasting.

Popular Tools:

- QuickBooks: A cloud-based accounting solution that offers cash flow forecasting features.

- Xero: An accounting platform that allows SMEs to create and manage cash flow projections.

- Zoho Books: A user-friendly tool for cash flow management, budgeting, and forecasting.

- Microsoft Excel: An affordable, customizable option for creating cash flow projections, especially for businesses just starting out.

Forecasting cash flow is an essential practice for all businesses, particularly SMEs in Botswana. By accurately predicting cash inflows and outflows, you can better manage your resources, avoid financial challenges, and plan for future growth. Whether you choose to do it manually or use automated tools, a reliable cash flow forecast will provide the insights needed to keep your business on track, even during difficult times.

For Botswana businesses, understanding local payment patterns, market trends, and seasonal fluctuations will allow you to create a more accurate and actionable forecast. By taking control of your cash flow, you’ll be in a stronger position to make informed financial decisions and ensure the long-term success of your business.